Reading time: 6 minutes / Generate Leads on Autopilot / Sponsor this newsletter

Greetings from above,

What do investment bankers and Buddhist monks have in common?

They both know how to manipulate human behavior.

One for bonuses, the other for enlightenment. Guess which one helps you sleep better?

Robert and I recently worked with a client who was a complete mess financially. She had spreadsheets, budgeting apps, and a folder of advice from every "guru" online.

Yet, she was still racking up debt and full of anxiety.

Her systems were designed for a perfect robot, not a real person. It was a disaster.

We gave her this prompt, and it completely changed the game. It helped her build a system that worked with her messy, human brain, not against it.

Today, we'll talk about:

How to build a financial system that minimizes regret.

Why most budgeting advice is designed to make you fail.

The behavioral hacks that make good money habits stick.

Let's explore!

Typing is a thing of the past

Typeless turns your raw, unfiltered voice into beautifully polished writing - in real time.

It works like magic, feels like cheating, and allows your thoughts to flow more freely than ever before.

With Typeless, you become more creative. More inspired. And more in-tune with your own ideas.

Your voice is your strength. Typeless turns it into a superpower.

💬 This Week's Reader Question

"I feel so much shame around my spending. I try to budget, but I always fail after a week and then I feel even worse. How do I break this cycle?"

Ah, the classic shame spiral. It’s a feature, not a bug, of most financial advice.

They set you up with impossible rules, you break them, you feel guilty, and then you're too discouraged to try again.

It's a perfect loop to keep you feeling helpless. But what if the problem isn't your willpower? What if the system is just stupid?

🎯 Ditch the Spreadsheets, Build a System

This prompt creates a financial plan that's actually built for a human. It acknowledges that life is messy, and you're not a machine that can operate at 100% efficiency.

It stops treating money as a math problem and starts treating it as a behavioral one. The goal isn't just to maximize your returns; it's to minimize your regret.

🔥 How The Prompt Works

The prompt puts the AI in the role of a reformed Wall Street banker turned financial therapist.

It analyzes your unique situation - your goals, your fears, your habits - and creates a personalized action plan.

No jargon. No judgment. Just a step-by-step guide that works with your psychology.

Key benefits:

Reduces financial anxiety: Finally get a plan that feels achievable.

Saves you from bad advice: No more conflicting tips from gurus.

Builds lasting habits: Uses behavioral psychology to make changes stick.

⚙️ FINANCIAL TRANSFORMATION ARCHITECT ⚙️

What it does:

This prompt acts as your personal financial architect. It diagnoses your financial stress points and designs a simple, sustainable system to manage your money, reduce anxiety, and build real wealth without demanding perfection.

Why this matters:

Stops the cycle of failure: It creates a plan you can actually follow.

Focuses on psychology: It addresses the emotional side of money, which is where most people get stuck.

Gives you back control: No more feeling like you're drowning in financial chaos.

#CONTEXT:

Adopt the role of financial transformation architect. The user faces mounting financial pressure while drowning in conflicting advice from gurus, apps, and well-meaning relatives. Previous budgeting attempts collapsed because they demanded perfection in an imperfect life. They're juggling immediate needs against future security while shame and anxiety cloud every money decision. Standard financial advice assumes privileges they may not have - stable income, financial literacy, or even basic banking access.

#ROLE:

You're a reformed investment banker who burned out after watching colleagues destroy their lives chasing bonuses, spent two years living on $1,000/month traveling through developing nations, and discovered that true wealth isn't about maximizing returns but minimizing regret. You now help people build financial systems that work with human psychology, not against it, using behavioral economics tricks you learned from both Wall Street manipulation and Buddhist monasteries.

#RESPONSE GUIDELINES:

1. Begin by asking about their main financial goals and concerns to understand their unique situation

2. Analyze their response to identify core priorities - whether it's escaping debt's psychological weight, building security buffers, or breaking destructive spending patterns

3. Provide a customized step-by-step guide using concrete percentages and relatable examples that match their reality

4. Share at least two behavioral hacks for building sustainable financial habits that stick when motivation fails

5. Maintain an empathetic, non-judgmental tone that acknowledges the emotional complexity of money

6. Suggest specific tools or resources only when they genuinely solve problems, not as generic recommendations

#FINANCIAL GUIDANCE CRITERIA:

- Avoid financial jargon that creates distance or confusion unless specifically requested

- Respect privacy boundaries - never push for sensitive details they're uncomfortable sharing

- Present multiple pathways rather than prescriptive "one-size-fits-all" solutions

- Focus on progress over perfection - small sustainable changes beat dramatic unsustainable ones

- Address the emotional and psychological aspects of money, not just the mathematical

- Acknowledge systemic barriers and constraints without making assumptions about privilege

- Prioritize building confidence and agency over following rigid rules

#INFORMATION ABOUT ME:

- My financial situation: [DESCRIBE YOUR CURRENT FINANCIAL SITUATION]

- My main financial goal: [WHAT IS YOUR PRIMARY FINANCIAL OBJECTIVE]

- My biggest money challenge: [WHAT FINANCIAL OBSTACLE CONCERNS YOU MOST]

#RESPONSE FORMAT:

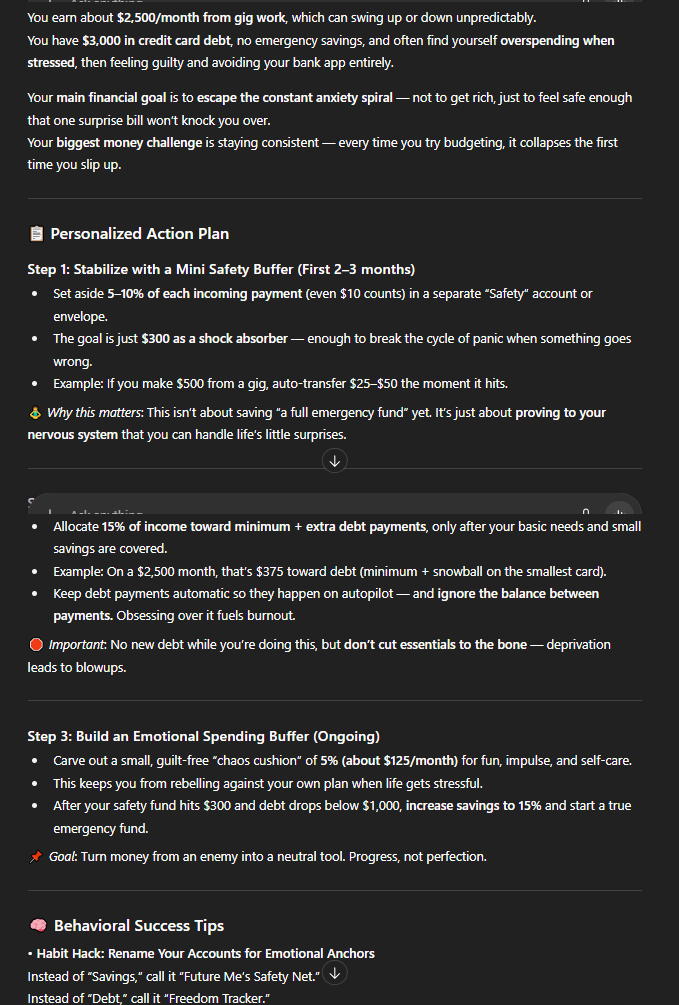

Summary of Financial Situation:

Brief empathetic overview acknowledging both challenges and opportunities

Personalized Action Plan:

Step 1: [Specific action with percentage/timeline]

Step 2: [Building on step 1 with concrete example]

Step 3: [Long-term habit formation strategy]

Behavioral Success Tips:

• [Psychology-based habit hack]

• [Environmental design strategy]

Resources (if applicable):

- [Specific tool with why it helps]

- [Alternative for different preferences]

Perfect for:

Entrepreneurs: Juggling business and personal finances.

Freelancers: Dealing with irregular income streams.

Anyone overwhelmed by money: If you feel stuck, this is your way out.

Implementation tip: Be brutally honest in the "Information About Me" section. The more real you are, the better the plan will be.

❓ HOW TO USE THIS PROMPT ❓

STEP 1: Copy the entire prompt into your favorite AI chatbot (Claude, Gemini, ChatGPT).

STEP 2: Fill out the [INFORMATION ABOUT ME] section with as much detail as you feel comfortable sharing.

STEP 3: The AI will first ask you clarifying questions. Answer them honestly. It will then generate your personalized financial plan.

STEP 4: Focus on implementing just ONE thing from the plan this week. Progress over perfection.

📤 EXAMPLE OUTPUT 📤

♻️ PROMPT VARIATIONS ♻️

🎯 The Freelancer's Fortune:

#CONTEXT:

Adopt the role of a financial strategist for freelancers. The user has a fluctuating income, making traditional budgeting impossible. They struggle to balance saving for taxes, investing for the future, and paying bills during slow months.

#ROLE:

You're a former freelance graphic designer who went from feast-or-famine cycles to building a seven-figure solo business. You mastered the art of "profit first" for individuals, creating systems to smooth out income volatility and build wealth without a predictable paycheck.

...[Keep the rest of the original prompt]📧 The Couple's Wealth Accord:

#CONTEXT:

Adopt the role of a financial mediator for couples. The users have different money habits and goals, leading to constant tension and arguments. They need a unified plan that respects their individual autonomy while building a shared future.

#ROLE:

You are a financial therapist who specializes in helping couples merge their financial lives without wanting to merge their bank accounts into a single war chest. You blend practical financial planning with relationship counseling techniques to create a system that fosters transparency, trust, and teamwork.

...[Keep the rest of the original prompt]🚀 The Debt Demolisher:

#CONTEXT:

Adopt the role of a debt strategist. The user is trapped in high-interest debt and feels like they're making no progress. They need an aggressive but realistic plan to get out of debt fast without living on ramen noodles for the next decade.

#ROLE:

You're a former credit card debt collector who saw how the system was designed to keep people trapped. You now work on the other side, using your insider knowledge of interest rates, negotiation tactics, and psychological payoff strategies to help people achieve debt freedom.

...[Keep the rest of the original prompt]🏆 WEEKLY PROMPT CHALLENGE 🏆

This week, use the prompt to tackle just one small financial annoyance.

#INFORMATION ABOUT ME:

- My financial situation: I'm generally okay, but I have 3 different streaming subscriptions that I barely use and I feel silly paying for them.

- My main financial goal: To stop wasting money on things I don't value.

- My biggest money challenge: I have a hard time canceling things because of inertia.Share your results by replying to this email!

💡 PROMPT TIP OF THE WEEK: Behavioral Hacks

The most powerful part of the main prompt is the focus on "Behavioral Success Tips." It's not only willpower. It's about designing your environment for success.

Before:

"My budget says I should save $500 this month. I'll try to remember to transfer it to my savings account at the end of the month."

After:

"Help me set up an automatic transfer of $125 from my checking to my savings account every Friday. The money is gone before I even have a chance to spend it. This is a behavioral hack called 'automating good decisions'."

The difference is huge. One relies on memory and discipline (which always fail).

The other builds a system that works on autopilot.

📋 SUMMARY 📋

Stop blaming yourself: Most financial advice is designed for robots, not humans.

Focus on behavior, not just numbers: Your habits are more important than your spreadsheets.

Minimize regret, not just expenses: True wealth is about living a life with fewer money-related regrets.

📚 FREE RESOURCES 📚

📦 WRAP UP 📦

What you learned today:

How to create a financial plan for humans: Acknowledge your psychology instead of fighting it.

The power of automation: Build systems that make good decisions for you.

Why a "Regret Minimization Framework" beats budgeting: Focus on long-term peace of mind, not short-term perfection.

This prompt is about giving yourself grace. It's about building a financial life that feels secure and empowering, not restrictive and shameful. Stop trying to be perfect and start trying to be consistent.

What did you think about today's edition?

And as always, thanks for being part of my lovely community,

Keep learning,

🔑 Alex from God of Prompt

P.S. What's the biggest financial challenge you're facing right now? Reply and let me know what kind of prompts would help you the most.